Institutional Insights: Goldmans Sachs 'Top 25 Earnings Season Trades'

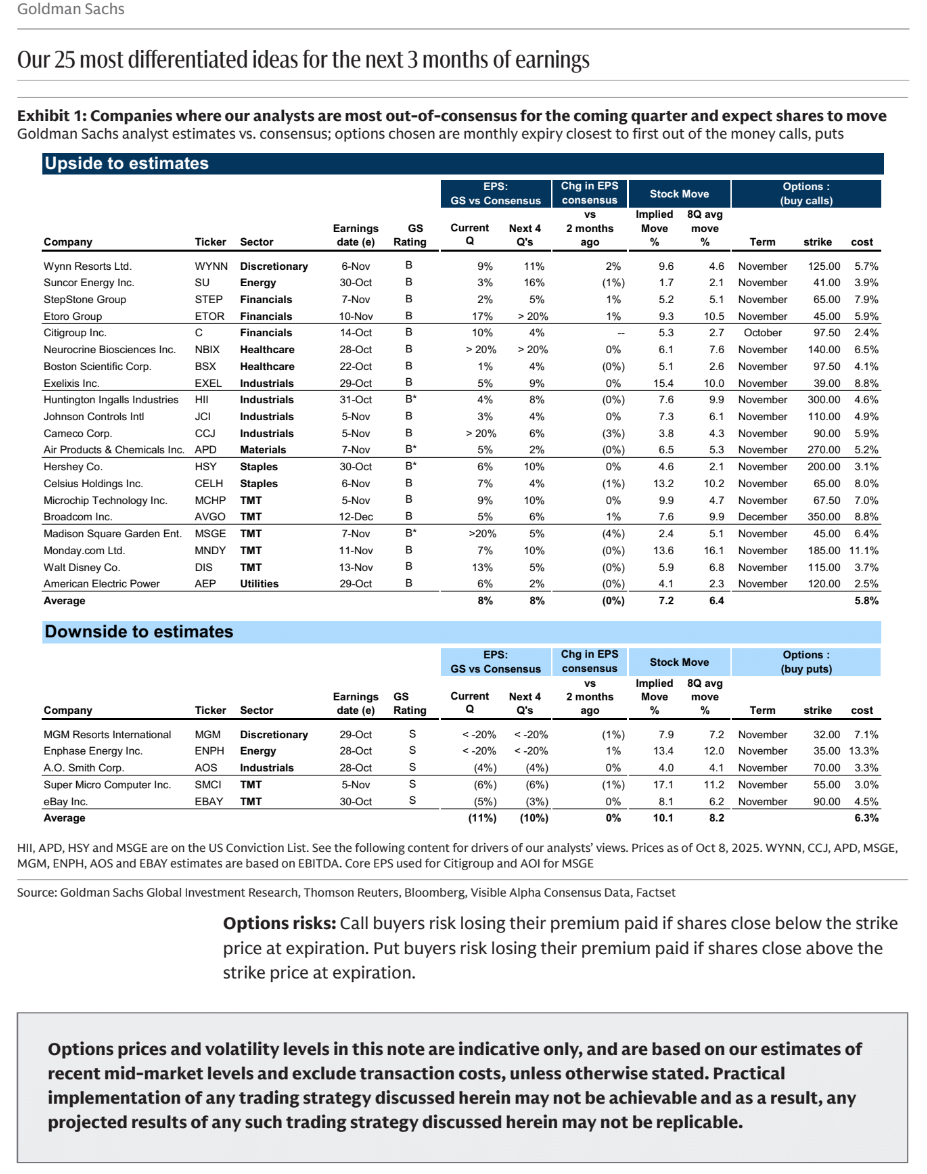

We have been working with our equity analysts for the past two weeks to pinpoint the 25 most unconventional opportunities within our Americas coverage. Our analysts anticipate that 20 companies, including AVGO, C, CCJ, DIS, and MCHP, will experience upward earnings revisions, while 5 companies, including MGM, ENPH, and SMCI, are expected to face downward revisions.

Last quarter, the average S&P 500 stock saw significant earnings day fluctuations, moving an average of +/-5.4%, a stark contrast to the typical non-earnings day movement, which is 4.5 times less. This indicates that and fundamental alpha has been mainly concentrated around earnings days.

Price targets have been adjusted upwards at a greater rate than stock prices themselves. Over the past three months, GS increased price targets for S&P 500 stocks by 11%, whereas the S&P itself rose by only 8%.

There’s been an unprecedented surge in call option volumes, raising concerns about potential crowding. However, we prefer using put-call skew as a gauge for crowding, which indicates a more balanced positioning among investors. Currently, put-call skew reflects a sentiment leaning towards upside potential, yet not reaching 2024 extremes. TSLA and 0DTE SPX options have significantly contributed to this volume, but their relevance as positioning indicators is limited.

We perceive recent buying activity from both Individual Investors and Global Macro Investors as a supportive factor for the upcoming weeks, rather than indicating crowding. After a pause in ETF purchases from April to May, Individual Investors resumed their buying in August. Meanwhile, Global Macro investors adjusted their risk following the FOMC's pause signal in December 2024 and quickly took on more risk again around the September rate cut decision.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!