BOE Easing Expectations Fall on Fresh UK Inflation Jump

UK Inflation Jumps Again

The British Pound is on watch today after the latest economic data this morning showed UK inflation rising for the first time in five months. Annualised headline CPI hit 3.4% last month, up from 3.2% prior and above the 3.3% the market was looking for. With inflation still well above the BOE’s target and pushing higher again this complicates the picture for the bank near-term and certainly shuts down any chance of a Feb rate cut and offers firm pushback against March easing expectations. Looking at the breakdown of the data, there are some seasonal factors which came into play such as the typical holiday-driven spike in airfares. Additionally, higher duties on tobacco fuelled an uptick in alcohol and tobacco prices. However, rising food prices generally were seen pushing CPI higher also, underscoring the remaining upwards pressures still facing the UK.

Dollar Rising on Trump Volatility

Despite the data, GBP is falling today against the Dollar though this is likely more a function of the rebound we’re seeing in USD today after a sharp drop lower yesterday. For now, the bigger driver remains the ongoing uncertainty around the US pursuit of Greenland. With Trump due to speak later today in Davos, ahead of EU leaders tomorrow, there is plenty of room for fresh volatility this week. For the UK, the threat of fresh tariffs from Trump is a key near-term risk with some signalling UK recession risks if Trump does tariff the UK.

Technical Views

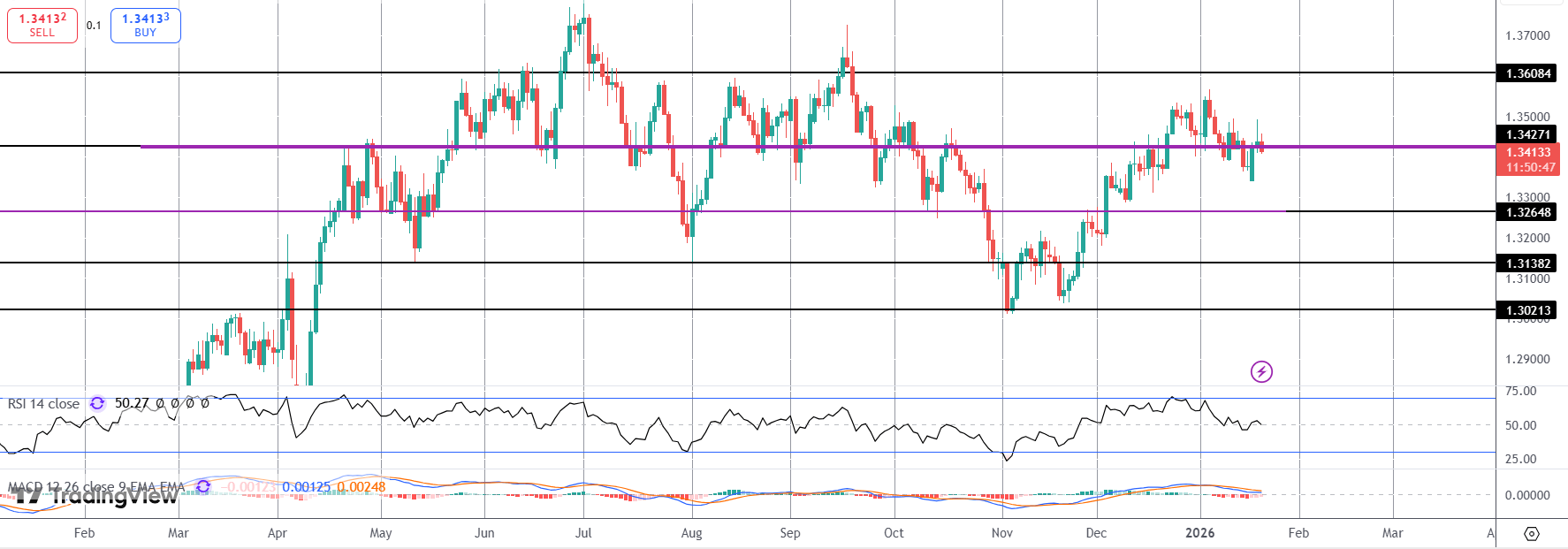

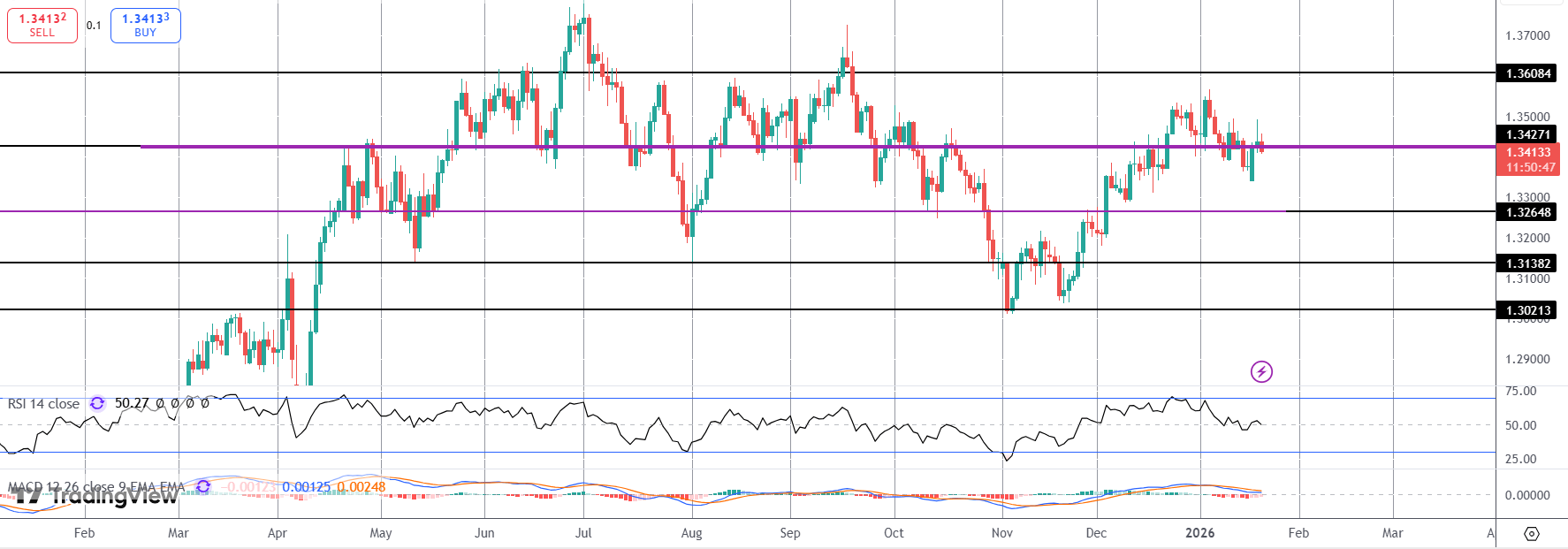

GBPUSD

The failure into yesterday’s highs has seen price reversing back under the 1.3427 level. While below here risks of a deeper push down towards the 1.3264 level are seen, in line with bearish momentum studies readings. Topside, 1.3608 remains the next target if bulls can hold back above 1.3427 near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.