Institutional Insights: Morgan Stanley US Quantitative Trading Desk View

Morgan Stanley Quantitative Trading Desk View

Tape Character (what changed vs “headline down day”)

Index declines were misleadingly mild versus what happened underneath.

The day was driven by factor and positioning, not broad macro panic:

Consensus longs / crowded momentum got hit.

Quant strategies held up better.

Flow felt orderly (no forced-liquidation vibe), but the mechanics made the selloff bite.

Core Read: “Momentum Crash” + “Anti-Crowding” Rotation

Primary move

Momentum had its worst drawdown in ~3 years.

The unwind was mainly long reductions (people trimming winners), not balanced de-grossing.

What got sold (risk-off inside risk-on)

High-beta, high-momentum, crowded themes:

AI beneficiaries, AI power, national security, bitcoin miners, other crowded “winners”

Noted single-stock pressure: NVDA, TSLA, AMD, MU, PLTR, MSTR (also semis broadly)

What outperformed (the flip side)

Laggards rallied sharply across sectors.

Rotation favored:

Early-cycle cyclicals, chemicals, regional banks (KRE +1.56%)

Some mega-cap defensives (select)

Market Structure (why the move had teeth)

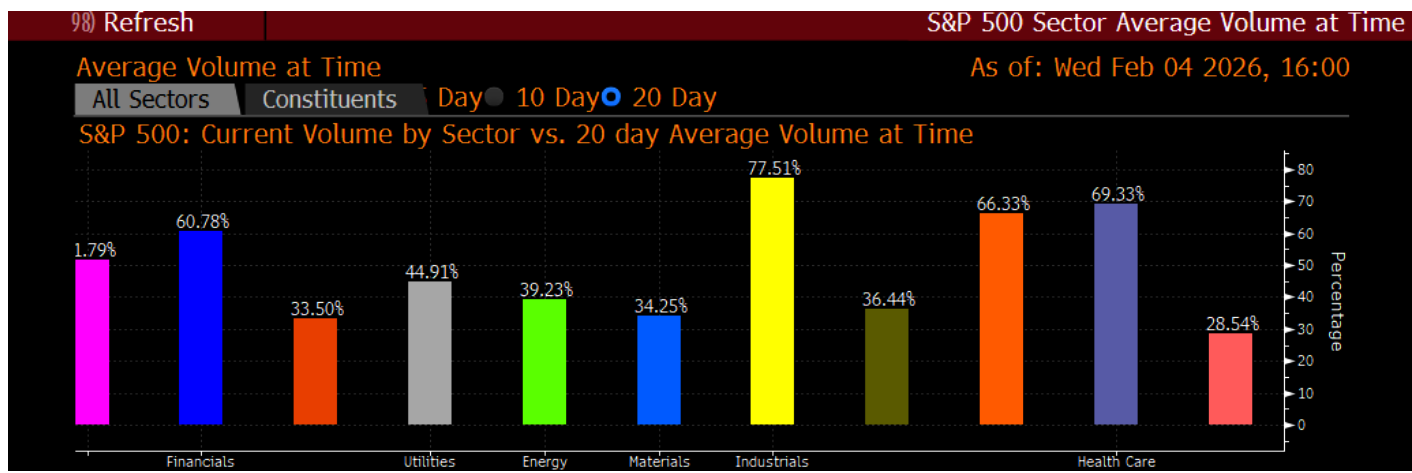

Levered ETF flow = big, directional supply

Estimated ~$18B of US equity supply from levered ETF rebalancing

Top-10 supply day on record

Supply concentrated in NDX / Tech / Semis, intensifying pain in the exact crowded areas.

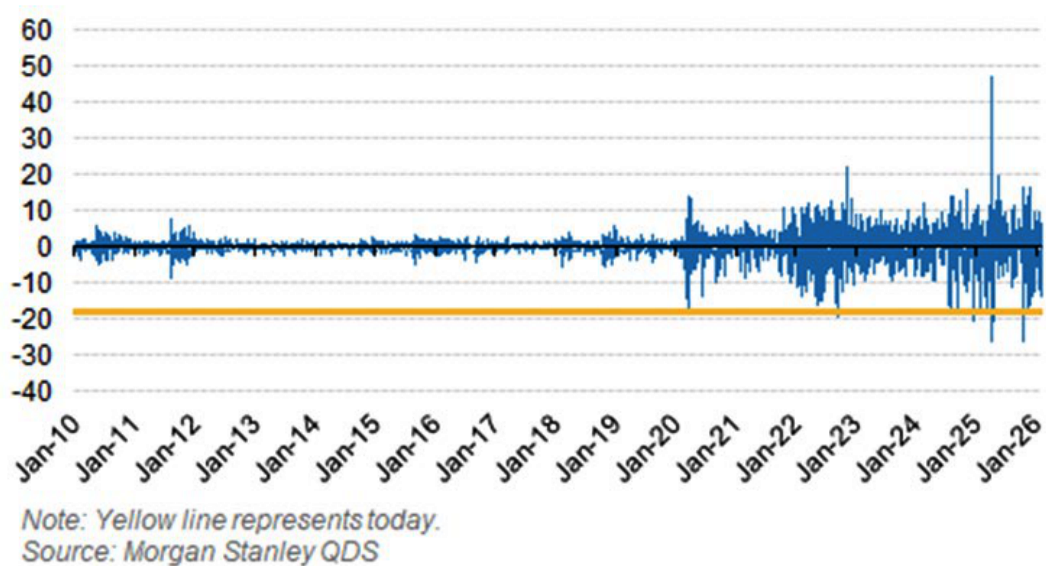

Options / gamma = less shock absorber than it looked

Dealers still long gamma, but that cushion shrunk.

After netting levered ETF short-gamma effects, the street was effectively net short gamma:

Selling tends to amplify intraday moves (more “chasey” downside, weaker mean reversion).

Forward Setup (next few sessions)

Base case risk

Systematic supply risk persists: estimate ~$10B over the coming week, especially if:

Vol stays elevated

Equity leverage (already high historically) starts to unwind

What to watch (tells)

Does Momentum keep bleeding or stabilize?

Continued pressure = more de-risking / mechanical selling

Stabilization = rotation may normalize into two-way trade

NDX / Semis relative strength

If they can’t reclaim leadership, “sell winners / buy losers” regime persists.

Intraday behavior

Big, persistent trends + poor bounce quality = net short-gamma feel still present

Cleaner mean reversion = gamma cushion returning / levered ETF flow fading

Breadth vs index

If breadth remains chaotic while the index looks “fine,” that’s still a hostile tape for crowded books.

Practical Trade Implications (how to express it)

Favor lower crowding / lower momentum exposure until the tape stops punishing winners.

In high-momentum names, treat rallies as risk-reduction opportunities unless leadership reasserts.

If playing rebounds, focus on laggard/rotation beneficiaries rather than trying to catch the most crowded AI/high-beta themes too early.

Expect bigger intraday ranges than index headlines imply while levered ETF and systematic flows are active.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!